Types Of SEC Cases: False Disclosures

SEC Sanctions Citadel Securities For False Disclosures

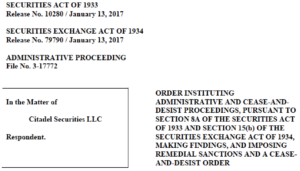

The SEC charged Citadel Securities LLC (“Citadel”) with making false disclosures to other broker-dealers about the way it priced trades. According to the SEC’s Administrative Order, Citadel made false disclosures pertaining to order execution for retail broker-dealer customers that used the firm’s services to execute order flow.

The SEC Order

Citadel Made The False Disclosures Through Its Execution Operations Department

In its Order, the SEC stated that Citadel disseminated the false disclosures through statements made by its Citadel Execution Services (”CES”) division. Citadel’s CES division operated as a specialized broker-dealer, commonly referred to as an “internalizer”, “OTC market maker,” or “wholesale market maker”. Retail broker-dealers commonly send orders for execution of trades placed by their retail customers to other broker-dealer specialists, such as CES, to handle the order flow and execution of the trades. The market maker typically handles marketable orders through automated systems that employ proprietary algorithms, which determine whether to execute the order in whole or in part as a principal, or to attempt to fill all or part of the order on a riskless principal basis by sending orders to other trading facilities, such as exchanges, dark pools, or other market makers.

Flow chart from the SEC’s press release

The False Disclosures

Between 2007 and 2010, CES provided a written disclosure to certain retail broker-dealer clients that defined a market order placed with CES as an “[o]rder to buy (sell) at the best offer (bid) currently available in the marketplace”. CES also made other similar representations to its clients regarding trade execution. In its Order, the SEC charged that these were false disclosures made by CES to its clients. The SEC determined that the statements made by CES assured its clients that CES would either internalize their orders or, through routing, attempt to obtain the best possible price for their orders. However, the SEC found that CES often did not execute client orders in this manner, because of the way trades were routed by two of its algorithms. As set forth in the Order, CES’s Fastfill and SmartProvide programs did not accurately find and fill orders at the best possible execution price. Often CES executed an order through one channel when a better price existed through another readily available channel. The SEC also found that in the case of SmartProvide, the algorithm would attempt to execute an initial order at a price below market. While this tactic worked for approximately 18% of the shares run through SmartProvide, the remaining shares had to be obtained through other means. Sometimes this resulted in executions at worse prices than they would have been had the trades been executed at the original market prices without using SmartProvide. Since CES did not disclose either of these trade aspects to its clients, and in conjunction with CES’s other representations mentioned above, the SEC determined that Citadel and its CES division provided materially misleading false disclosures to its clients and willfully violated the Securities Act.

The SEC’s press release

Citadel Securities made misleading statements suggesting that it would provide or try to get the best prices it saw for retail orders routed by other broker-dealers … Internalizers can’t suggest that they are doing one thing yet do another when it comes to pricing trades.

Disgorgement And Penalties Ordered

Citadel submitted an Offer of Settlement that was accepted by the SEC. The settlement included Citadel’s agreement to the following:- $5,200,000 disgorgement

- $1,465,268 prejudgment interest

- $16,000,000 penalty

- Censure

- Cease and desist from committing or causing any violations and any future violations of Section 17(a)(2) of the Securities Act

Whistleblowers Can Report False Disclosures To The SEC

This case illustrates some types of misconduct that could give rise to SEC whistleblower cases if reported to the Commission through the SEC whistleblower program. However, the SEC has not made any public statement as to whether this case was itself an actual SEC whistleblower case. The SEC Office of the Whistleblower posts Notices of Covered Action (“NoCA”) for Commission actions where a final judgment or order results in monetary sanctions exceeding $1 million. The NoCA list does not disclose if a particular Enforcement action was brought as the result of an SEC whistleblower case, tip, complaint, or referral being filed with the Commission.Additional Information

For more information about false disclosures fraud, click on the links below:- The SEC’s Order in the Citadel case. (External link to the SEC’s website.)

- The SEC’s Press Release announcing the Citadel sanctions. (External link to the SEC’s website.)