SEC Charges Company For Violating Whistleblower Protection Rules By Impeding Investors From Communicating With The Commission

In 2019, the U.S. Securities and Exchange Commission (“SEC”) staked out its position that its whistleblower protection rules safeguard anyone, including investors, who wants to report potential securities law violations or frauds to it.

The SEC made clear its position in a case involving a company called Collectors Café. In that case, the SEC sued Collectors Café and its CEO Mykalai Kontilai.

Initially, the SEC alleged that Collectors Café and Kontilai violated the federal securities laws by making false and misleading statements and material omissions. The SEC also charged Kontilai with misappropriating more than $6.1 million of investors’ money to fund his lavish lifestyle. (Amended court Complaint, pp. 2, 8.)

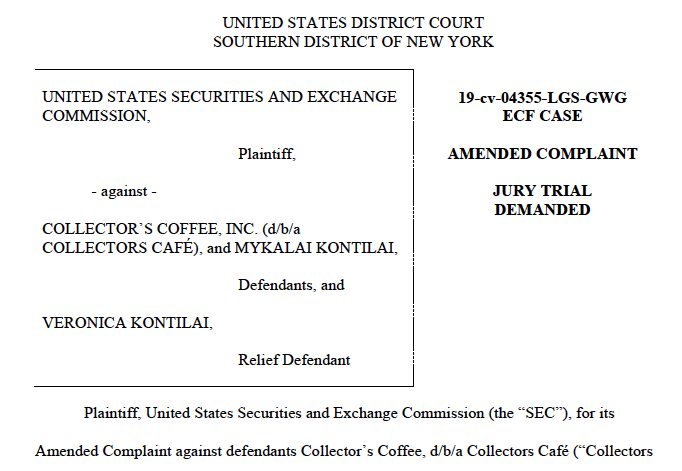

Later, the SEC amended its court Complaint to add claims that Collectors Café and Kontilai violated the SEC’s whistleblower protection rules.

The SEC’s amended court Complaint

A Provision In An SPA Allegedly Violated Whistleblower Protection Rules

As explained by the SEC, some investors in Collectors Café raised concerns to the company. Thereafter, Kontalai supposedly arranged for his sister-in-law to purchase those investors’ stock in Collectors Café from them. (Amended court Complaint, p. 27.)

To do the stock sale, the parties entered into a stock purchase agreement (“SPA”). The SPA was signed by Kontilai on behalf of Collectors Café. The SPA contained the following provision:

[Investors] …. further warrant and affirm that … they will not, directly or indirectly, individually, collectively or otherwise, contact any third-part, including, but not limited to governmental or administrative agencies or enforcement bodies, for the purpose of commencing or otherwise prompting investigation or other action relative to [Collectors Café] or the subject matter herein. (Amended court Complaint, p. 28) (brackets and ellipses in original.)

According to the SEC, this provision in the SPA violated its whistleblower protection rules by impeding the investors who signed it from communicating with the SEC.

A Clause In A Settlement Agreement Also Allegedly Violated Whistleblower Protection Rules

Two investors sued Collectors Café for securities fraud, among other things. They settled their lawsuit by entering into a confidential settlement agreement with Collectors Café and Kontilai. The settlement agreement contained the following clause:

The Shareholders … will not initiate on a going forward basis, any communications with any regulatory agencies such as the United States Securities and Exchange Commission or any other Federal, State, or Local governmental agency concerning the matters related to this Agreement. Nothing herein would prevent the parties from responding to, and/or fully complying with, a subpoena or other governmental and or regulatory compulsory process. (Amended court Complaint, p. 29) (emphasis in original.)

At some point after the settlement agreement was signed, the investors’ lawyer told the SEC that the settlement agreement “prevented his clients from speaking to SEC staff voluntarily”. (Amended court Complaint, p. 30.)

The SEC’s amended court Complaint claims that the settlement agreement impeded these two investors from communicating with the SEC and other governmental agencies, in violation of the SEC’s whistleblower protection rules.

Collectors Café’s Sued The Two Investors In Court

Later, the lawyer for Collectors Café and Kontilai’s told the investors’ attorney that his clients believed that the investors had been in communication with the SEC, in violation of the settlement agreement.

Subsequently, Collectors Café and Kontilai brought a lawsuit against the investors seeking both punitive and compensatory damages. (Amended court Complaint, pp. 30-31.)

Each of the claims in Collectors Café and Kontilai’s lawsuit were “based on the factual allegation that the investors communicated with the SEC about Collectors Café and Kontilai”. (Amended court Complaint, p. 30.)

In addition, the SEC contended that Collectors Café and Kontilai “flaunted to other investors the fact that they had sued investors for communicating with the SEC”. (Amended court Complaint, p. 3.) The SEC’s amended court Complaint states that Kontilai had a call with all of Collectors Café’s investors. During that telephone call, Kontilai supposedly referred to the lawsuit against the two investors, and the damages he was suing the investors for, several times. He also allegedly said that he “intended to amend this lawsuit to include others whom he viewed as the source of the company’s troubles”. (Amended court Complaint, p. 31.)

The SEC alleged that Collectors Café and Kontilai’s lawsuit against the two investors, and Kontilai’s statements during the telephone call, were designed “to impede investors from communicating directly with SEC staff about a possible securities law violation, including by enforcing and threatening to enforce confidentiality agreements”. (Amended court Complaint, p. 31.) Therefore, according to the SEC, these acts and statements violated the SEC’s whistleblower protection rules.

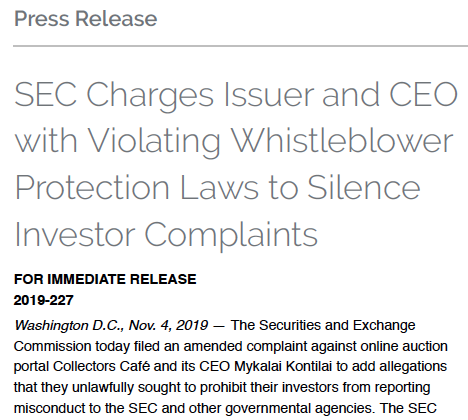

The SEC’s press release

The SEC Charged Collectors Café and Kontilai With “Impeding”

In the SEC’s amended court Complaint, it added a Fifth Cause of Action for “Impeding” investors from communicating with the SEC about possible securities frauds, in violation of the SEC’s whistleblower protection rules. (Amended court Complaint, p. 40.)

Commenting about the case in an SEC press release, the Director of the SEC’s Denver Regional Office said, “We allege that the defendants attempted to cover up their fraud by holding investors’ money hostage until the investors signed agreements preventing them from seeking law enforcement intervention”.

In the press release, the Chief of the SEC’s Office of the Whistleblower asserted that “The SEC’s whistleblower protections broadly protect not just employees, but anyone who seeks to report potential securities law violations to the Commission”.

Additional Information

For additional information about the SEC’s enforcement of its whistleblower protection rules, click on the links below:

- The SEC’s amended court Complaint in the Collectors Café case. (External link to the SEC’s website.)

- The SEC’s press release about the amended Complaint in the Collectors Café case. (External link to the SEC’s website.)

- Article about the Collectors Café case. (Note: external link to The Pickholz Law Offices website.)

- Article about other cases brought by the SEC to enforce whistleblower protections. (Note: external link to The Pickholz Law Offices website.)