SEC Whistleblower Requirements: Mandatory Form And Manner Rules

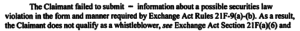

To fully participate in the SEC whistleblower program, potential whistleblowers must satisfy the SEC whistleblower requirements. One of those requirements is that potential whistleblowers must file their information in the “form and manner” that the SEC prescribes. On November 7, 2016, the SEC entered an Order denying an SEC whistleblower award because the award claimant had failed to follow the SEC whistleblower requirements. The reason given in the Order is that:The Claimant failed to submit — [redacted in original] information about a possible securities law violation in the form and manner required by Exchange Act Rules 21F-9(a)-(b). As a result, the Claimant does not qualify as a whistleblower … and is not eligible for an award…

The language quoted above from the Order is significant, because it does not only say that the claimant’s failure to follow the form and manner requirements preludes him or her from receiving an award. It also says that the claimant’s failure to follow the form and manner requirements means that he or she does not even “qualify as a whistleblower” under the SEC whistleblower program.

Excerpt from the SEC’s Order

SEC Whistleblower Requirements: Form TCR

The Order specifically refers to the SEC whistleblower requirements set forth in Rules 21F-9(a)-(b) as the basis for denying an award to the claimant. SEC whistleblower Rule 21F-9(a) states that “to be considered a whistleblower”, a person must submit their information to the SEC on a Form TCR. The Form TCR can be filed either online through the SEC’s website, or by mailing or faxing a paper copy of it to the SEC Office of the Whistleblower. For more information about the Form TCR, click here. SEC whistleblower Rule 21F-9(b) adds that to be eligible for a whistleblower award, when an individual submits information to the SEC, he or she must declare under penalty of perjury that their information is “true and correct” to the best of their knowledge and belief.SEC Whistleblower Requirements: Definition Of “Whistleblower”

The Order also cites SEC rules 21F-2(a)(1) and 21F-2(a)(2). Those are the SEC whistleblower Rules that provide the definition of “whistleblower” for purposes of the SEC whistleblower program. Rule 21F-2(a) states that an SEC whistleblower must be an individual, not a company or entity, who provides the SEC with information in accordance with the SEC’s procedures. The information provided by the individual has to relate to a possible violation of the federal securities laws. Subsection (a)(2) says that in order to be eligible to receive SEC whistleblower awards, whistleblowers must submit their original information to the SEC in accordance with certain procedures and conditions set forth elsewhere in the SEC’s rules.

The SEC Order

SEC Whistleblower Rule 21F-8(a)

Another provision cited in the Order is Rule 21F-8(a). Rule 21F-8(a) explains that a whistleblower must provide his or her information “in the form and manner that the Commission requires” in order to be eligible to receive an SEC whistleblower award. This includes submitting original information, as well as making a proper claim for an award under the SEC whistleblower program. In addition, SEC Rule 21F-8(a) instructs potential SEC whistleblowers that:You should read these procedures carefully because you need to follow them in order to be eligible for an award, except that the Commission may, in its sole discretion, waive any of these procedures based upon a showing of extraordinary circumstances.

Additional Information

For additional information about these SEC whistleblower requirements, click on the link below:- The SEC’s November 7, 2016 Order. (External link to the SEC’s website.)