Types Of SEC Cases: Town Bond Fraud

SEC Charges Government Officials With Town Bond Fraud

The SEC accused Ramapo, N.Y. (“Ramapo”), its local development corporation, and four town officials with engaging in a municipal town bond fraud. The SEC alleged that the four officials hid Ramapo’s deteriorating financial situation from municipal bond investors. In its court Complaint, the SEC charged Christopher P. St. Lawrence, Nachman Aaron Troodler, Michael Klein, and Nathan Oberman, with committing public statement fraud by making numerous false or misleading statements and omissions about the financial condition of the Town of Ramapo and the Ramapo Local Development Corporation (“RLDC”) in connection with 16 municipal securities offerings between September 2010 and September 2015.

The SEC’s court Complaint

Baseball Stadium Cover-Up Leads To Town Bond Fraud

According to the SEC, in 2010, the Town of Ramapo and the RLDC set out to build a minor league baseball stadium, later named Provident Bank Park. Politically, this turned out to be an unpopular municipal project. It cost at least $60 million to construct, and immediately began to put a strain on Ramapo’s finances, which were already impaired by declining property and sales tax revenues. In a press release, the Chief of the SEC Enforcement Divisionʼs Public Finance Abuse Unit summarized the SEC’s case: “We allege that Ramapoʼs senior-most officials concealed the true condition of the townʼs declining finances to avoid further political fallout from the construction of the baseball stadium”.

The SEC’s press release

Specific Acts In Furtherance Of The Town Bond Fraud

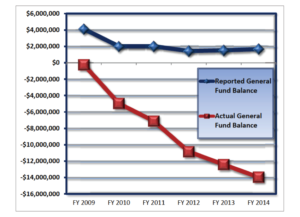

The SEC’s court Complaint set forth numerous allegedly false statements and acts of misconduct that contributed to the municipal town bond fraud, including accounting fraud, false statements to auditors, and books and records violations. Some of the SEC’s allegations included:- Lawrence masterminded and directed a scheme to artificially inflate the balance of the General Fund by recognizing fraudulent receivables, omitting unpaid liabilities, and improperly recording transfers from other funds with different tax bases.

- Klein, the Town Attorney, aided in the town bond fraud by helping to conceal outstanding liabilities related to the baseball stadium and making repeated misleading statements to Ramapo’s auditors.

- Troodler, an assistant Ramapo attorney and former RLDC Executive Director, participated in the town bond fraud by certifying official statements that contained fraudulent receivables.

- Oberman, Ramapo’s Deputy Finance Director, joined in the scheme by, among other things, directing improper transfers from the Ambulance Fund to the General Fund.

The SEC Demands A Jury Trial

In its court Complaint, the SEC’s demanded a jury trial against Ramapo. This made it one of the few cases in which the SEC has sought a jury trial against a municipality. The first case ever in which the SEC pursued a federal jury trial against a municipality or one of its officers for violations of the federal securities laws involved the City of Miami (FL). That case was filed in court approximately three years before the Ramapo case, with the SEC winning a jury verdict in September 2016.Whistleblowers Can Report Municipal Town Bond Fraud To The SEC

This case illustrates some types of misconduct that could give rise to SEC whistleblower cases if reported to the Commission through the SEC whistleblower program. However, the SEC has not made any public statement as to whether this case was itself an actual SEC whistleblower case. The SEC Office of the Whistleblower posts Notices of Covered Action (“NoCA”) for Commission actions where a final judgment or order results in monetary sanctions exceeding $1 million. The NoCA list does not disclose if a particular Enforcement action was brought as the result of an SEC whistleblower case, tip, complaint, or referral being filed with the Commission.Additional Information

For more information about municipal town bond fraud, click on the links below:- The SEC’s court Complaint & Jury Demand in SEC v. Ramapo. (External link to the SEC’s website.)

- The SEC’s Press Release announcing the charges. (External link to the SEC’s website.)